SaaS: A business model that chases its own tail

A sustainable business is one in which the business can make revenue to fund itself, at the minimum its operating costs in the short run and in the long run make profits to expand the business reach. Where there is continuous inflow of VC funding to even operate a business, the business is just churning. That is like zig-zagging in Bangalore traffic, moving horizontally and creating an illusion of movement, but the total effect is that you are still stuck behind yet another car. Such a business is chasing its own tail and is not sustainable in the long run. The only way such a business becomes successful is, if, there is a buyer with deep pockets at the end of the line or the business can go public and the ignorant public can fund it indefinitely.

Taking a simple brick-and-mortar retail business, the model is pretty simple. There are costs associated with buying the goods, transporting the goods, costs associated with the warehouse, store and shelf rentals, maintenance costs and administrative costs. All these costs taken into consideration, the price of the item is marked up and sold at a higher price than what it was bought for. So, an item bought at Rs10 possibly was sold for Rs15 giving the retailer a profit of say 50p to Rs1 per item, that is then be invested back into the business. Rarely, is a bottle of water at a retail shop sold for less than the wholesale price. The advantage to the customer is that they save on the cost of travel and can buy the item locally. The advantage to the businesses is they make profits that gives them the leeway to venture into newer markets. So, it is a win-win situation. When this became an online retail business, the costs involved typically reduced by the cost of the physical store rental and maybe some administrative cost. This reduction is passed on to the consumer in the form of discounts. So, instead of Rs15, possible the same item can be sold at Rs13. To note here is that the “primary product” that is being sold is NOT the features of the online retail app. The profits are computed against the “sold product” rather than the online web app. The online web app is only a mechanism of marketing.

While the SaaS business and online retail business are not comparable and business models are different between the two, the basic business principles need to be retained in whatever manner to get a profitable business. The most basic principle being, the business can start off with an “initial working capital investment” that covers the initial startup costs, but, subsequently, there needs to be a progressively increasing profit that can create a churn to develop a self-sustainable model to keep the business afloat. The cost of the sold unit needs to be comparable to the cost of the sold unit and the costs involved after the sale is made needs to be zero or a cost that can be accounted for in the price of the unit sold.

None of the above seems to apply in the SaaS world. In the SaaS world. There is no definition of a single unit of product sold and hence computing a cost against anything seems meaningless. It does not matter whether there is 1 customer or 1000 customers, the cost of developing the initial product and subsequently enhancing the product with newer features remains the same fixed cost. Thus initial costs start at a very high value and henceforth costs associated with a customer only progressively increase. The initial cost is never comparable to the sold cost per customer. It can be easily argued that initial cost is typically amortised across customers and can be made up for over the years where revenue and cost cross over. This can only be true if the R&D cost was not a burgeoning cost. The current market scenario for SaaS product is such that the cost to revenue comparison is in the range of 1:0.01 i.e., for every dollar spent, I only make a cent or less. This means customers need to increase by 100-fold to match cost. Sure, the same customer can pay over a period of time more money and hence become comparable. But, the R&D costs cannot be suspended during that time, so no matter what for every cent earned I am spending 1 dollar continuously. To add to it, the marketing and operations cost start burgeoning to improve market reach to increase the customer by 100-fold.

The other point, of “costs going to zero” once sold to a customer is not possible in the SaaS world. In fact, in the SaaS world, once the product is sold to a customer, it becomes all the the more imperative that extra cost be associated with the sold product to ensure it is up and running for the SLA. As opposed to resources becoming available for devoting to the next customer, more resources are in fact consumed as the customer base grows. Hence, this goes into a model that “chases its own tail”.

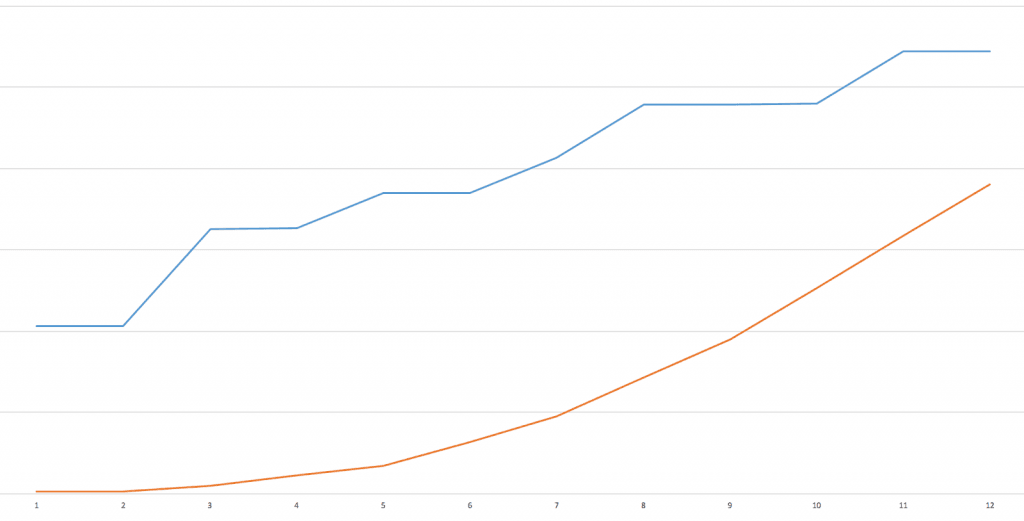

Sure, it can be argued that pricing models can be formulated with non-linear increase with customers. But, it should be noted this just implies the number of high value customers need to increase faster than low and medium value customers. It can be considered as a balancing act. But, irrespective work involved always appropriately increases and hence increasing the cost. The graph always looks as below: (blue is cost and red revenue, revenue being really optimistic in this graph)

Sure, it looks as if the red is going to meet the blue line somewhere if we continued further along this rate of increase. But, the practical nature of increasing the red curve implies that the blue also goes up due to R&D, support, marketing and operation requirements. Forever the red is chasing the blue to catch up. The major problem to be conceded here is that the costs start at a initial very high value while the revenue starts at 0 and there is no going away from it.

It can be argued that the same is true of a license model which existed previously. But the major difference to note here is that the cost to revenue comparison was not at a very low range as it is in SaaS, but more comparable range, which made amortising cost across customers more manageable because per customer costs were controllable.

One way in which this can be turned around is to find a way to reduce the R&D costs involved to productise the idea. With the existing methodologies and going rate of resources involved in developing products, this is a practical impossibility. What is needed is a total overhaul and rethinking of how products are developed, so that the time to market and resources and cost involved in time to market is reduced to comparable levels of the incoming revenue.

While cloud-hosting has totally revamped the infrastructure industry, its impact on the product industry has not been recognised. The major impact of the cloud infrastructure is the instantaneous availability of products to customers as opposed to the age old implementation with huge IT installations and related tasks before a product can be used. This has given the false impression that the amount of work involved in delivering a software product has reduced while in fact it has increased. This false impression has driven the price at which a customer expects a feature to be available, way down below any comparable levels with the actual costs involved.

On the other hand, the product development industry has not reimagined itself for the changes in delivery mechanisms of the product. It has not moved towards a direction where actually the amount of work involved to deliver the software is reduced. This has caused this huge mismatch between costs and revenues and created a business that chases its own tail.

Published on Java Code Geeks with permission by Raji Sankar, partner at our JCG program. See the original article here: SaaS: A business model that chases its own tail Opinions expressed by Java Code Geeks contributors are their own. |